The Teachers Service Commission, TSC, has introduced a new deduction on teachers’ payslips. The deduction referred to as Provident Fund will see teachers shelve a portion of their monthly salaries towards the scheme.

Provident fund is another name for pension fund. Its purpose is to provide employees with lump sum payments at the time of exit from their place of employment. This differs from pension funds, which have elements of both lump sum as well as monthly pension payments. As far as differences between gratuity and provident funds are concerned, although both types involve lump sum payments at the end of employment, the former operates as a defined benefit plan, while the latter is a defined contribution plan.

The new contributory pension scheme will see government employees (including teachers) contribute 7.5% of their monthly basic salaries; while the employer tops up with 15% of the employee’s basic salary.

To make the burden lighter for teachers, they will contribute only 2% of their basic pay in the first year (2021). In 2022 (the second year), teachers will contribute 5% of their basic pay while the full 7.5% deduction will be effected as from the third year (2023).

WHO WILL BE COVERED BY THE NEW PENSION SCHEME

The scheme will cover all employees of the Public Service who are recruited through:

- the Public Service Commission, PSC;

- the Teachers Service Commission, TSC;

- the National Police Service Commission, NPSC; or

- any other service that the Cabinet Secretary determines to be public service for the purposes of the Act.

The scheme will be mandatory for all employees aged below 45 years. On the other hand, the current Public Service Pension arrangement will be closed to all new employees and all serving employees who will be aged below 45 years as at 1st January, 2021. Employees aged 45 years and above as at that date will be given an option to join the new Scheme or remain in the old Scheme.

You may also like;

- TSC leaves for teachers: Sick, maternity, paternity, study and all other leaves

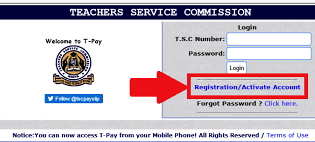

- TSC Payslips; Registration, Login, details, password reset and how to download

- TSC allowances paid to teachers: Latest TSC News

- TSC News Portal: The Teachers Service Commission

HOW THE PENSION SCHEME WILL WORK

As opposed to the current pension scheme (where the government shoulders full payment responsibility), in the new scheme both the employer and employee will contribute equally.

This scheme is portable and allows employees to transfer their services to other employers without losing their pension benefits. Employees who for any reason exit Government service before the retirement date, will be allowed to access their own accumulated contributions and a further 50% of the Government portion on leaving service.

Under the new scheme, monthly contributions by employees of up to 30% of their basic salary or Kshs. 20,000 whichever is lower will be tax deductible. This means that the contribution is deducted from the salary before tax is calculated. This in effect reduces the tax level and improves the pay of an employee as well as avoiding double taxation of pension contributions and pension payouts.

The new scheme ensures involvement of the employees and members in the management of their retirement fund through participation in the Board of Trustees in accordance with the Retirement Benefits Authority. This in essence enhances a sense of ownership and oversight of the management of the fund.

Benefits of the new contributory Pension scheme

The new contributory pension scheme comes with a number of benefits. These include:

- An employee can transfer pension benefit credits from a former employer to another with a similar Pension scheme.

- The scheme allows employees to access part of their benefits even before the mandatory retirement age.

- Teachers joining the scheme from non-contributory pension scheme will have their past benefits transferred to the new scheme.

- Widows and Children’s Pension Scheme (WCPS) and NSSF contribution will cease immediately an employee joins the scheme.

- Those who remain in the free Pension Act will be bound by the provision of the Pensions Act cap 189.

Here are links to the most important news portals:

Universities and Colleges News Portal

Free Teaching Resources and Revision Materials